On September 4, just one week after the release of the Mini Labubu, reporters found that its resale price on trendy toy platforms had begun to fall. Some scalpers commented, “The Mini Labubu doesn’t have the same lasting demand as the third-generation Labubu.”

According to data from the Dewu app, over 56,000 units of the Mini Labubu have been sold within the first week. The average transaction price for a single blind box in the past three days was 138 yuan, still 75% higher than the original price of 79 yuan. However, compared with the initial launch period, the secondary market price of the Mini Labubu has dropped by 10%–60%.

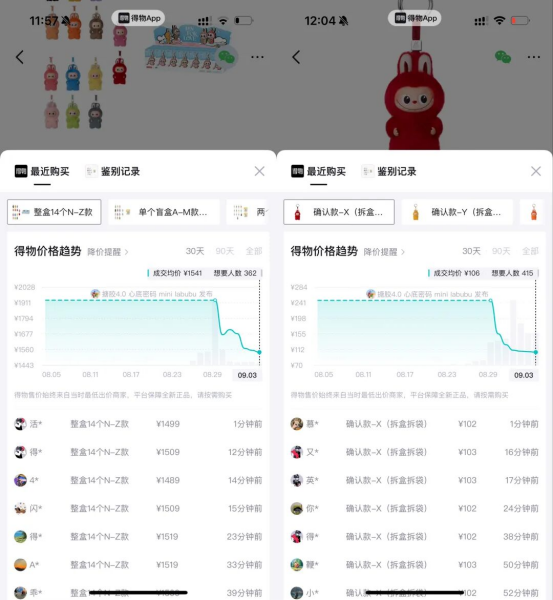

For example, a set of 14 pieces (N–Z box), originally priced at 1,106 yuan, saw its average transaction price on Dewu soar to 1,930 yuan on release day. By yesterday, the price had fallen back to 1,541 yuan, a 20% drop. The number of “interested buyers” also declined from 9,398 to 362. For non-popular models, the average price of “X” fell to 106 yuan yesterday, down 57% from the release day. Data from Xianyu also shows that the average transaction price of Labubu 4.0 dropped from 143 yuan on August 27 to 106 yuan.

Even the scarce hidden editions were not spared. Under the A/B group format of the Mini Labubu, the probability of getting a hidden figure is as low as 1:168. Before the official release, some second-hand platforms had speculated the “Hidden Heart” edition to over 1,000 yuan. Reporters found that its current average transaction price on Dewu had dropped from 991 yuan on release day to 679 yuan.

A scalper revealed that the full-box price of the Mini Labubu he sells had dropped from 2,399 yuan before release to 1,850 yuan for the A–M box and 1,800 yuan for the N–Z box. His sales pitch has also changed to: “The market changes every day; the earlier you buy, the earlier you enjoy.” In second-hand trading groups, some scalpers remarked, “The Mini Labubu doesn’t have the same momentum as the third generation, and buyers’ price expectations are weakening. With the next round of restocks, price fluctuations will become greater.”

Compared with the third-generation Labubu, the Mini version’s premium has significantly decreased. Taking the hidden editions as an example, even after five months of release and large-scale distribution, on September 3 the third-generation Labubu hidden edition still sold at an average of 939 yuan on Dewu—a 9.5x premium, higher than the current 8.6x premium of the Mini Labubu Hidden Heart edition.

On one hand, Pop Mart is taking measures to minimize scalpers’ interference. An industry insider analyzed that the rapid price decline of the Mini Labubu was mainly due to higher supply, with larger quantities released initially; the series consists of 30 products, so user-driven exchanges reduced secondary market circulation; and all sales were conducted online, with physical stores only handling pick-ups, thereby lowering offline scalping. The insider predicted that Pop Mart is likely to launch a second wave of Mini Labubu products in October, when prices may continue to decline to some extent.

On the other hand, internet industry analyst Zhang Shule told reporters that the Mini Labubu is unlikely to generate further social media buzz, at most achieving short-lived hype. As Labubu’s overall popularity fades, it will be difficult to create new sales miracles, and the Mini version serves more as a marketing move to fill a gap period.

According to Wind data, since the launch of the Mini Labubu, Pop Mart (09992.HK) shares have fallen by 5.61% over the past five days as of press time.

Declaration: This article comes from China Business Network.If copyright issues are involved, please contact us to delete.